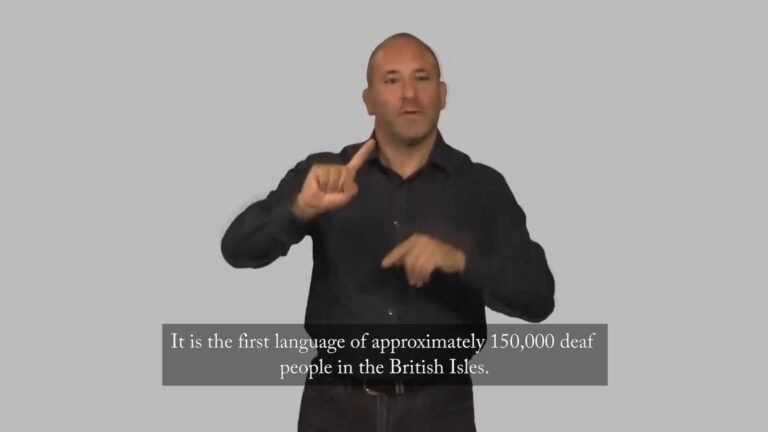

British Sign Language (BSL) Level 1 & 2

Level 2 QLS Endorsed | 24/7 Student Support | 50% OFF Certificate & Transcript

18396 Students enrolled on this course 4.8 (20 Reviews)

Last updated March 27, 2024

Last updated March 27, 2024

Course Curriculum

| British Sign language (BSL) Level 1 Online Course | |||

| Introduction to BSL | 00:04:00 | ||

| Alphabet Finger spelling and Names Practice | |||

| Alphabet with | 00:01:00 | ||

| Alphabet | 00:01:00 | ||

| Fingerspelling test | 00:01:00 | ||

| Fingerspelling replay | 00:01:00 | ||

| Names test | 00:04:00 | ||

| Names replay | 00:04:00 | ||

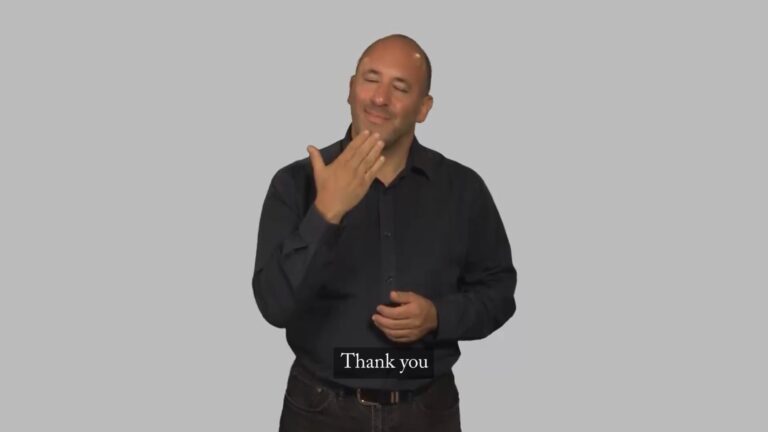

| Greetings | |||

| Greetings | 00:05:00 | ||

| Greetings without voice try these yourself | 00:04:00 | ||

| Family, question forms and family story | |||

| Family Vocabulary | 00:02:00 | ||

| Family vocabulary test your memory | 00:03:00 | ||

| Question forms | 00:01:00 | ||

| Question forms test your memory | 00:01:00 | ||

| Family story test | 00:03:00 | ||

| Family Story Recap How did you do | 00:03:00 | ||

| Rooms in the house vocabulary | |||

| Rooms in the house Vocabulary | 00:02:00 | ||

| Kitchen Vocabulary | 00:02:00 | ||

| Bathroom Vocabulary | 00:01:00 | ||

| Bedroom Vocabulary | 00:01:00 | ||

| Living room and Dining room Vocabulary | 00:02:00 | ||

| Study Vocabulary | 00:01:00 | ||

| Utility room Vocabulary | 00:01:00 | ||

| Garden Vocabulary | 00:01:00 | ||

| Colours | |||

| Colours | 00:01:00 | ||

| Colours test yourself | 00:01:00 | ||

| Questions and statements about the home | |||

| Questions and statements about home test | 00:01:00 | ||

| Questions and statements about the home replay were you right | 00:01:00 | ||

| Animals | |||

| Animal Vocabulary | 00:03:00 | ||

| Animal vocab replay test your knowledge | 00:03:00 | ||

| Short animal story | 00:01:00 | ||

| Short animal story replay were you right | 00:01:00 | ||

| Animal and pet questions | 00:01:00 | ||

| Animal and pet question replay were you right | 00:01:00 | ||

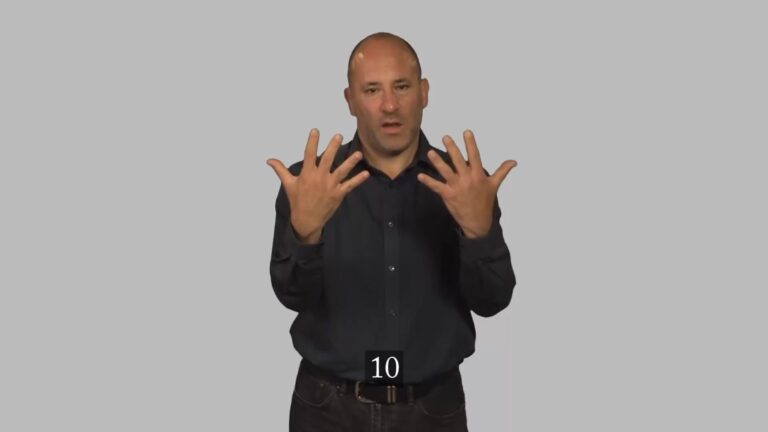

| Numbers and Money | |||

| Numbers 1-30 | 00:02:00 | ||

| Numbers 1-30 replay without voice test yourself | 00:02:00 | ||

| Numbers 10’s, 100’s | 00:02:00 | ||

| Numbers 10’s, 100’s replay without voice test yourself | 00:01:00 | ||

| Mixed number test | 00:01:00 | ||

| Mixed number test replay | 00:01:00 | ||

| Money £1 – £20 | 00:01:00 | ||

| Money £1 – £20 replay test your knowledge | 00:01:00 | ||

| Mixed money test | 00:01:00 | ||

| Mixed money test replay | 00:01:00 | ||

| Time and Months of the Year | |||

| Time 1 o’clock to 12 o’clock | 00:01:00 | ||

| Days of the week | 00:01:00 | ||

| Months of the year | 00:01:00 | ||

| Time periods | 00:02:00 | ||

| Time periods replay test your knowledge | 00:02:00 | ||

| Describing Ages | |||

| Describing ages | 00:01:00 | ||

| Describing ages replay without voice test your knowledge | 00:01:00 | ||

| Number and ages phrase test | 00:02:00 | ||

| Number & Ages phrase test replay | 00:02:00 | ||

| Mixed time, ages and money test | 00:03:00 | ||

| Mixed time, ages, and money test replay | 00:03:00 | ||

| Weather | |||

| Weather Vocabulary | 00:02:00 | ||

| Weather vocab without voice test your understanding | 00:02:00 | ||

| Weather phrase test | 00:04:00 | ||

| Weather phrase test replay | 00:02:00 | ||

| Transport | |||

| Transport Vocabulary | 00:04:00 | ||

| Transport vocabulary without subtitles – test yourself | 00:04:00 | ||

| Transport phrases without subtitles | 00:03:00 | ||

| Transport phrases replay with subtitles | 00:03:00 | ||

| Directions | |||

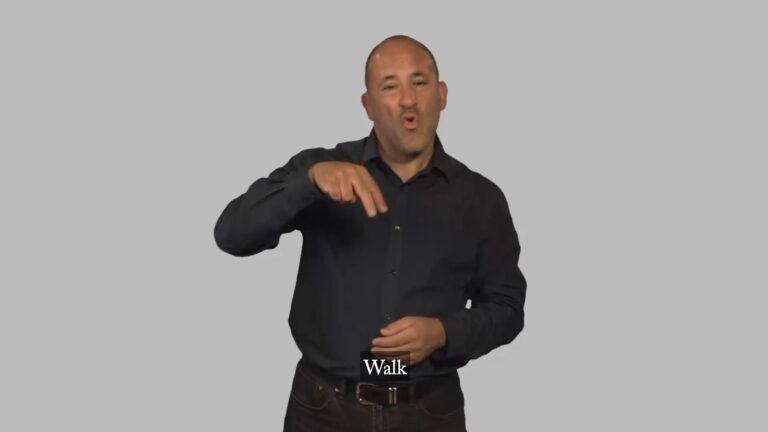

| Directions Vocabulary | 00:02:00 | ||

| Directions vocabulary without subtitles test yourself | 00:02:00 | ||

| Direction phrases test without subtitles | 00:03:00 | ||

| Direction phrases replay with subtitles | 00:03:00 | ||

| Hobbies | |||

| Hobbies Vocabulary | 00:03:00 | ||

| Hobbies vocabulary without subtitles test yourself | 00:03:00 | ||

| Hobbies phrases test | 00:04:00 | ||

| Hobbies phrases replay with subtitles | 00:04:00 | ||

| Work | |||

| Work Vocabulary | 00:05:00 | ||

| Work vocabulary without subtitles test yourself | 00:05:00 | ||

| Work phrases test | 00:04:00 | ||

| Work phrases replay with subtitles | 00:04:00 | ||

| Food and Drink | |||

| Food and Drink Vocabulary | 00:08:00 | ||

| Food and drink without subtitles | 00:08:00 | ||

| Food and drink phrases without subtitles | 00:04:00 | ||

| Food and Drink phrases replay with subtitles | 00:04:00 | ||

| Dialogues No Voice No Subtitles | |||

| The broken car | 00:02:00 | ||

| Tom’s 18th Birthday Party | 00:03:00 | ||

| New House | 00:05:00 | ||

| At the bank without | 00:01:00 | ||

| On a train | 00:02:00 | ||

| Going to a restaurant without | 00:02:00 | ||

| Going on a picnic without | 00:02:00 | ||

| Job interview day | 00:01:00 | ||

| Horse riding without | 00:09:00 | ||

| I’m lost and need directions | 00:01:00 | ||

| Valentine’s Day | 00:04:00 | ||

| A day in hospital without | 00:01:00 | ||

| Learning to drive | 00:02:00 | ||

| Meeting up with the family | 00:01:00 | ||

| Dialogues with voice and subtitles | |||

| The broken car | 00:02:00 | ||

| Tom’s 18th birthday party | 00:02:00 | ||

| New house | 00:02:00 | ||

| At the bank | 00:01:00 | ||

| On a train | 00:02:00 | ||

| Going to a restaurant | 00:02:00 | ||

| Going on a picnic | 00:02:00 | ||

| Job interview day | 00:02:00 | ||

| Horse riding | 00:01:00 | ||

| I’m lost and need directions | 00:01:00 | ||

| Valentines Day | 00:01:00 | ||

| A day in hospital | 00:02:00 | ||

| Learning to drive | 00:03:00 | ||

| School reunion | 00:02:00 | ||

| Meeting up with the family | 00:02:00 | ||

| Bonus 5 Stories with voice and subtitles | |||

| Tom’s 18th Birthday Party | 00:03:00 | ||

| New house | 00:05:00 | ||

| On a Train | 00:05:00 | ||

| Valentines day | 00:04:00 | ||

| Learning to drive | 00:03:00 | ||

| Bonus 5 stories with no voice over | |||

| Tom’s 18th Birthday Party | 00:03:00 | ||

| New House | 00:05:00 | ||

| On a train | 00:04:00 | ||

| Valentine’s Day | 00:04:00 | ||

| Learning to drive | 00:03:00 | ||

| Level 2 British Sign Language | |||

| Family Vocabulary | |||

| Family Vocabulary No Voice over | 00:03:00 | ||

| Family | 00:02:00 | ||

| Describing People and Animals | |||

| Describing People No Voice Over | 00:01:00 | ||

| Describing People | 00:01:00 | ||

| Ethnic Groups No Voice Over | 00:01:00 | ||

| Ethnic Groups | 00:01:00 | ||

| Religion No Voice Over | 00:01:00 | ||

| Religion | 00:01:00 | ||

| Clothes No Voice Over | 00:02:00 | ||

| Clothes | 00:02:00 | ||

| Colour No Voice Over | 00:01:00 | ||

| Colours | 00:01:00 | ||

| Feelings No Voice Over | 00:01:00 | ||

| Feelings | 00:01:00 | ||

| Feelings 2 No Voice Over | 00:01:00 | ||

| Feelings 2 | 00:01:00 | ||

| Animals No Voice Over | 00:01:00 | ||

| Animals | 00:01:00 | ||

| Activities at School | |||

| Activities At School No Voice Over | 00:01:00 | ||

| Activities At School | 00:01:00 | ||

| People Who Work In Schools No Voice Over | 00:01:00 | ||

| People Who Work In Schools | 00:01:00 | ||

| School Vocabulary No Voice Over | 00:02:00 | ||

| School Vocabulary | 00:02:00 | ||

| Subjects No Voice Over | 00:01:00 | ||

| Subjects | 00:01:00 | ||

| School Vocabulary 2 No Voice Over | 00:01:00 | ||

| School Vocabulary 2 | 00:01:00 | ||

| Jobs and activities at work | |||

| Jobs No Voice Over | 00:02:00 | ||

| Jobs | 00:02:00 | ||

| Applying For Work No Voice Over | 00:01:00 | ||

| Applying For Work | 00:01:00 | ||

| Office No Voice Over | 00:01:00 | ||

| Office | 00:01:00 | ||

| Firm No Voice Over | 00:01:00 | ||

| Firm | 00:01:00 | ||

| Meetings No Voice Over | 00:01:00 | ||

| Meetings | 00:01:00 | ||

| Time | |||

| Time Vocabulary No Voice Over | 00:02:00 | ||

| Time Vocabulary | 00:02:00 | ||

| Activities in the home | |||

| Activities In The Home No Voice Over | 00:01:00 | ||

| Activities In The Home | 00:01:00 | ||

| Go Out To Work no Voice Over | 00:01:00 | ||

| Go Out To Work | 00:01:00 | ||

| Do The Washing No Voice Over | 00:01:00 | ||

| Do The Washing | 00:01:00 | ||

| Flats No Voice over | 00:01:00 | ||

| Flat | 00:01:00 | ||

| Leisure activities | |||

| Leisure Activities No Voice Over | 00:01:00 | ||

| Leisure Activities | 00:01:00 | ||

| Hobbies No Voice Over | 00:01:00 | ||

| Hobbies | 00:01:00 | ||

| Going Out No Voice Over | 00:01:00 | ||

| Going Out | 00:01:00 | ||

| Plan Tickets No Voice Over | 00:01:00 | ||

| Plan | 00:01:00 | ||

| DIY No Voice Over | 00:01:00 | ||

| DIY | 00:01:00 | ||

| Opinions Likes and Dislikes | |||

| Attitudes And Opinions No Voice Over | 00:02:00 | ||

| Attitudes And Opinions | 00:02:00 | ||

| Opinions No Voice Over | 00:01:00 | ||

| Opinions | 00:01:00 | ||

| Illnesses and Health | |||

| Illnesses No Voice Over | 00:01:00 | ||

| Illnesses | 00:01:00 | ||

| Treatment No Voice Over | 00:01:00 | ||

| Treatment | 00:01:00 | ||

| Eating and Drinking | |||

| Eating And Drinking Vocabulary No Voice Over | 00:01:00 | ||

| Eating And Drinking | 00:01:00 | ||

| Drinks No Voice Over | 00:01:00 | ||

| Drinks | 00:01:00 | ||

| Cereal No Voice Over | 00:01:00 | ||

| Cereal | 00:01:00 | ||

| Fruit No Voice Over | 00:01:00 | ||

| Fruit | 00:01:00 | ||

| 5Veg No Voice Over | 00:01:00 | ||

| Vegetables | 00:01:00 | ||

| Main Meal No Voice Over | 00:01:00 | ||

| Main Meal | 00:01:00 | ||

| Sweets No Voice Over | 00:01:00 | ||

| Sweets | 00:01:00 | ||

| Hot Food And Drink No Voice Over | 00:01:00 | ||

| Hot Food-Drinks | 00:01:00 | ||

| Payment No Voice Over | 00:01:00 | ||

| Payment | 00:01:00 | ||

| Shopping and Spending | |||

| Shopping And Spending No Voice Over | 00:02:00 | ||

| Shopping And Spending | 00:02:00 | ||

| Expensive No Voice Over | 00:04:00 | ||

| Expensive | 00:01:00 | ||

| Shops No Voice Over | 00:01:00 | ||

| Shops | 00:02:00 | ||

| Travel and Holidays | |||

| Travel And Holidays No Voice Over | 00:01:00 | ||

| Travel And Holidays | 00:01:00 | ||

| Travelling No Voice Over | 00:01:00 | ||

| Travelling | 00:01:00 | ||

| Vehicles No Voice Over | 00:02:00 | ||

| Vehicles | 00:02:00 | ||

| Directions No Voice Over | 00:01:00 | ||

| Directions | 00:01:00 | ||

| Going Abroad No Voice Over | 00:01:00 | ||

| Going Abroad | 00:01:00 | ||

| Breakdown No Voice Over | 00:01:00 | ||

| Breakdown | 00:01:00 | ||

| Places No Voice Over | 00:03:00 | ||

| Places | 00:02:00 | ||

| Holidays No Voice Over | 00:01:00 | ||

| Holidays | 00:01:00 | ||

| Hotel No Voice Over | 00:01:00 | ||

| Hotel | 00:01:00 | ||

| Beach No Voice Over | 00:01:00 | ||

| Beach | 00:01:00 | ||

| Complaints No Voice Over | 00:01:00 | ||

| Complaints And Compliments | 00:01:00 | ||

| Excellent No Voice Over | 00:01:00 | ||

| Excellent | 00:01:00 | ||

| Level 2 dialogues without voice and subtitles | |||

| The Broken Leg | 00:02:00 | ||

| Surprise Holiday | 00:02:00 | ||

| It’s Snowing | 00:01:00 | ||

| Shopping | 00:02:00 | ||

| Taking The Dog For A Walk | 00:01:00 | ||

| First Day At New a Job | 00:02:00 | ||

| On The Beach | 00:02:00 | ||

| First Day At School | 00:04:00 | ||

| In The Park | 00:01:00 | ||

| On a Plane | 00:01:00 | ||

| At The Doctors | 00:03:00 | ||

| Pets | 00:01:00 | ||

| Family | 00:02:00 | ||

| My New Kitchen | 00:02:00 | ||

| Designing a New Garden | 00:02:00 | ||

| Level 2 Dialogues with voice over and subtitles | |||

| The Broken Leg | 00:02:00 | ||

| Surprise Holiday | 00:02:00 | ||

| Snowing | 00:01:00 | ||

| Shopping | 00:02:00 | ||

| Taking My Dog For a Walk | 00:01:00 | ||

| First Day At a New Job | 00:02:00 | ||

| On The Beach | 00:02:00 | ||

| First Day At School | 00:01:00 | ||

| In The Park | 00:01:00 | ||

| On a Plane | 00:01:00 | ||

| At the Doctors | 00:03:00 | ||

| Pets | 00:02:00 | ||

| Family | 00:02:00 | ||

| My New Kitchen | 00:02:00 | ||

| Designing a New Garden | 00:02:00 | ||

| 5 stories with no voice over and no subtitles | |||

| First day at School | 00:04:00 | ||

| Taking the dog for a walk | 00:04:00 | ||

| At the Doctors | 00:03:00 | ||

| First Pet | 00:03:00 | ||

| Designing a New Garden | 00:03:00 | ||

| 5 stories with voice over and subtitles | |||

| First Day at School | 00:04:00 | ||

| Taking the Dog For a Walk | 00:04:00 | ||

| At the Doctors | 00:03:00 | ||

| First Pet | 00:04:00 | ||

| Designing a New Garden | 00:03:00 | ||

| Assignment | |||

| Assignment – British Sign Language (BSL) Level 1 & 2 | 2 weeks, 2 days | ||

| Order your Certificates & Transcripts | |||

| Order your Certificates & Transcripts | 00:00:00 | ||

Course Reviews

Frequently asked questions

Can’t find the anwser you’re looking for ? Reach out to customer support team.

Becoming proficient in BSL varies depending on various factors like dedication, practice, and learning pace. Generally, achieving basic conversational skills might take around 6 months of consistent learning. Mastery and fluency, however, could take several years of ongoing practice and immersion.

Yes, BSL and ASL are distinct languages with unique grammar, vocabulary, and syntax. BSL is primarily used in the United Kingdom and has its own linguistic structure, while ASL is used in the United States and Canada. Learning one doesn't necessarily mean proficiency in the other.

Yes, there are regional variations in BSL, just as there are in spoken languages. Different areas might have slightly different signs or expressions. However, the fundamentals of BSL remain consistent, allowing communication across regions.

Absolutely! BSL is a language open to everyone, regardless of age, background, or ability. It's a visual language that can be learned by anyone willing to dedicate time and effort to understand and communicate through signs and gestures.

Yes, learning BSL can open doors to various career paths. Opportunities exist in education as sign language interpreters, in healthcare as communication support workers, within the deaf community as advocates or counsellors, and in various customer service roles. Proficiency in BSL can be an asset in many fields aiming for inclusivity and accessibility.

LOGIN/Sign up

LOGIN/Sign up

i would recommend everyone who are intrested to learn sign language.

British sign language can be difficult to learn since it is very complex so I did not expect that I would be learning a lot from here. Thank you very much for providing a level 1 and 2 sign language course. I can say that I was able to save since it’s already a 2-in-1 course.

Katia Martin

This is the perfect start towards BSL. Good explanations for the handshapes. Very Interesting.

Catherine Armijo

good explanation of how to perform the signs! would definitely recommend to others.

Margaret Kelly

It’s very clear and concise. So happy I bought this course

John Chandler

Enjoyed taking this course which i could do at my own pace

John Chandler

Enjoyed taking this course which i could do at my own pace

Allen Dahlke

I found this course very informative. It gave me a clear understanding of BSL. I found it difficult at times and with many thanks to my tutor, who helped me with the honest feedback on assignments from time.

Really helpful and good structure. I am recommending that course!

Great course

Great course for the price leaning

sarah

exellent course . learn a lot on sign language etc .thank u

Joshua Mason

That’s it! This is the best British Sign Language (BSL) course I’ve found.

Harvey Collins

Level 1 and 2 of British Sign Language (BSL) were fantastic. It’s extraordinary!

Taylor Sullivan

The ad and course description were amazing. So, I had a high expectation for this course. The course was good and easily understandable. The communication vocabulary part could be better. Overall, satisfactory experience.

Thomas Nixon

This course is fabulous. A 5 star course. It is very to recap and check if you forget anything. Plus, you’re getting level 1 and 2 altogether. It’s a great bergain.

Joe Reynolds

This BSL (British sign language) course covered every important topic.

Charlie Humphreys

I just started the course, and it seems amazing! I am sure I’ll have a great experience.

Luca Fisher

British Sign Language is an extremely useful course!

Shannon Thorpe

I loved the curriculum. The lessons are easy and enjoyable. A great experience.

David Hayward

Janet’s British Sign Language (BSL) Level 1 & 2 is something I really suggest to all.

Tyler Walters

An excellent course to learn sign language. It was an exciting experience for me.