Tax Accounting

Level 5 QLS Endorsed | CPDUK Accredited

777 Students enrolled on this course 4.6 (7 Reviews)

Last updated May 17, 2024

Last updated May 17, 2024

Course Curriculum

| Module 01: Tax System and Administration in the UK | |||

| Tax System and Administration in the UK7 | 00:25:00 | ||

| Module 02: Tax on Individuals | |||

| Tax on Individuals7 | 00:23:00 | ||

| Module 03: National Insurance | |||

| National Insurance7 | 00:13:00 | ||

| Module 04: How to Submit a Self-Assessment Tax Return | |||

| How to Submit a Self-Assessment Tax Return7 | 00:12:00 | ||

| Module 05: Fundamentals of Income Tax | |||

| Fundamentals of Income Tax7 | 00:22:00 | ||

| Module 06: Advanced Income Tax | |||

| Advanced Income Tax7 | 00:45:00 | ||

| Module 07: Payee, Payroll and Wages | |||

| Payee, Payroll and Wages7 | 00:18:00 | ||

| Module 08: Capital Gain Tax | |||

| Capital Gain Tax7 | 00:32:00 | ||

| Module 09: Value Added Tax | |||

| Value Added Tax7 | 00:24:00 | ||

| Module 10: Import and Export | |||

| Import and Export7 | 00:24:00 | ||

| Module 11: Corporation Tax | |||

| Corporation Tax7 | 00:17:00 | ||

| Module 12: Inheritance Tax | |||

| Inheritance Tax7 | 00:34:00 | ||

| Module 13: Double Entry Accounting | |||

| Double Entry Accounting7 | 00:11:00 | ||

| Module 14: Management Accounting and Financial Analysis | |||

| Management Accounting and Financial Analysis7 | 00:14:00 | ||

| Module 15: Career as a Tax Accountant in the UK | |||

| Career as a Tax Accountant in the UK7 | 00:16:00 | ||

| Mock Exam | |||

| Mock Exam – Tax Accounting | 00:20:00 | ||

| Final Exam | |||

| Final Exam – Tax Accounting | 00:20:00 | ||

| Assignment | |||

| Assignment – Tax Accounting | 2 weeks, 1 day | ||

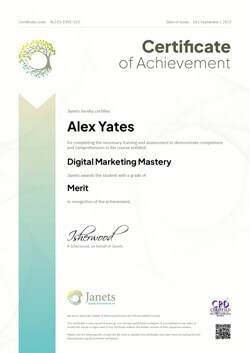

| Order your Certificates & Transcripts | |||

| Order your Certificates & Transcripts | 00:00:00 | ||

Course Reviews

No Reviews found for this course.

Frequently asked questions

Can’t find the anwser you’re looking for ? Reach out to customer support team.

Tax accounting is a structure of accounting methods focused on taxes rather than the appearance of public financial statements. It is governed by the internal revenue code, which dictates the specific rules that companies and individuals must follow when preparing their tax returns.

The main methods of tax accounting include: 1. Cash Method: Recognizes income and expenses when they are actually received or paid. 2. Accrual Method: Recognizes income and expenses when they are earned or incurred, regardless of when the cash transaction occurs.

The tax basis of accounting refers to the method of recognizing income and expenses for tax purposes. This method focuses on timing and the nature of the recognition of items as they affect taxable income.

The focus of tax accounting is on items such as income, deductions, gains, losses, and investments, all particularly as they pertain to taxation. Its main objective is compliance with the legal requirements set by tax laws and regulations.

The main types of accounting include: 1. Financial Accounting 2. Managerial Accounting 3. Cost Accounting 4. Tax Accounting 5. Forensic Accounting

The golden rules of accounting are fundamental principles used to manage accounts: 1. Debit the receiver, credit the giver: Applied to real accounts. 2. Debit what comes in, credit what goes out: Applied to personal accounts. 3. Debit all expenses and losses, credit all incomes and gains: Applied to nominal accounts.

The three primary accounting methods are: 1. Cash Basis 2. Accrual Basis 3. Hybrid Method

Financial accounting focuses on providing information to external users (such as shareholders) about the financial health of the organization based on generally accepted accounting principles (GAAP). In contrast, tax accounting focuses on reporting income and filing tax returns according to IRS rules, which might differ significantly from GAAP.

Tax Basis: Refers to the method of accounting that conforms to tax laws for reporting revenue and expenses in the preparation of the tax return. GAAP Basis: Refers to accounting that adheres to established principles ensuring consistent reporting and disclosure practices in financial statements.

Two primary types of accounting are: 1. Financial Accounting: Recording and classifying business transactions, and preparing and presenting financial statements to external users. 2. Managerial Accounting: Providing information to managers within the organization to aid in decision-making.

The tax depreciation method refers to the way depreciation expense is calculated for tax purposes. Common methods include the Modified Accelerated Cost Recovery System (MACRS) in the U.S., which allows for accelerated depreciation of assets.

An accounting system is a structured process of collecting, recording, summarizing, and reporting financial transactions to oversight agencies, regulators, and tax collection entities. The system can be manual or software-based.

An audit in accounting is the systematic review and assessment of the financial statements of an organization to ensure that they provide a fair and accurate representation of the transactions they claim to represent, in accordance with the accounting standards.

IFRS (International Financial Reporting Standards) are a set of accounting standards developed by the International Accounting Standards Board (IASB) that are becoming the global standard for the preparation of public company financial statements. The system is designed to bring consistency to accounting language, practices, and statements on a global scale.

13

13 Business Essestials - Effective Communication

Business Essestials - Effective Communication  1 Digital Certificate (Preorder Special Discount)

1 Digital Certificate (Preorder Special Discount)  SharePoint Foundation Basics

SharePoint Foundation Basics  Pet Food Making Course

Pet Food Making Course  Depression Counseling

Depression Counseling  Diet and Nutrition for Beauty

Diet and Nutrition for Beauty  Mastering Spanish Language

Mastering Spanish Language  Risk Management Certificate Course Level 2

Risk Management Certificate Course Level 2  Active Listening Diploma

Active Listening Diploma  Professional Supervision Skills - Level 2

Professional Supervision Skills - Level 2  Health & Social Care UK Standards: 5 in 1 Bundle (Certificate Included)

Health & Social Care UK Standards: 5 in 1 Bundle (Certificate Included)  LOGIN/Sign up

LOGIN/Sign up