Xero Accounting and Bookkeeping Training

CPDUK Accredited | 50% OFF Certificate & Transcript

1991 Students enrolled on this course 4.7 (11 Reviews)

Last updated April 17, 2024

Last updated April 17, 2024

Course Curriculum

| Getting Prepared - Access the software and course materials | |||

| Introduction To The Course And Your Tutor | 00:04:00 | ||

| Activating Your Free Trial With Xero | 00:02:00 | ||

| Getting started | |||

| Signing Up For The Free Trial | 00:04:00 | ||

| Instruction of Updated Xero Accounting Software | 00:00:00 | ||

| Create The Organisation | 00:08:00 | ||

| The Ficticious Scenario | 00:02:00 | ||

| Setting up the system | |||

| Add Bank Accounts To The System | 00:14:00 | ||

| Enter Opening Balances | 00:07:00 | ||

| Opening Trial Balance | 00:01:00 | ||

| Nominal ledger | |||

| Amend The Nominal Ledger | 00:06:00 | ||

| Chart Of Accounts Report | 00:01:00 | ||

| Customers & Suppliers | |||

| Enter customers | 00:07:00 | ||

| Entering suppliers | 00:06:00 | ||

| Reporting Customer And Supplier Information | 00:02:00 | ||

| Sales ledger | |||

| Enter Invoices | 00:07:00 | ||

| Invoicing tips – adding logo, repeat billing | 00:09:00 | ||

| Entering Invoices 6574 to 6610 | 00:16:00 | ||

| Post Credit Notes | 00:03:00 | ||

| Report Showing Customer Activity | 00:08:00 | ||

| Aged Debtors | 00:02:00 | ||

| Suppliers | |||

| Post supplier invoices | 00:09:00 | ||

| Enter suppliers invoices 6028 onwards | 00:14:00 | ||

| Enter More Supplier Invoices No 4308 Onwards | 00:06:00 | ||

| Credit Notes Suppliers | 00:02:00 | ||

| Supplier Activity Report | 00:04:00 | ||

| Aged Creditors Info | 00:01:00 | ||

| Purchases ledger | |||

| Reciepts from Customers | 00:10:00 | ||

| Apply Customer Credit Notes | 00:05:00 | ||

| Sundry payments | |||

| Post Supplier Cheques | 00:08:00 | ||

| Apply Supplier Credit Notes | 00:03:00 | ||

| Print List Of Bank Receipts And Payments | 00:01:00 | ||

| Sundry payments | |||

| Post Sundry Payments | 00:07:00 | ||

| Make a credit card payment | 00:08:00 | ||

| Petty Cash | |||

| Add Petty Cash Transactions – Week 1 | 00:16:00 | ||

| Add Petty Cash Transactions – Week 2 | 00:12:00 | ||

| Add Petty Cash Transactions – Week 3 | 00:07:00 | ||

| Add Petty Cash Transactions – Week 4 | 00:09:00 | ||

| Imprest System on Petty Cash | 00:04:00 | ||

| Print a Copy of Petty Cash Receipts and Payments | 00:01:00 | ||

| Bad Debt | |||

| Writing Off A Bad Debt – Print Customer Statement | 00:02:00 | ||

| Write Off A Bad Debt | 00:09:00 | ||

| Credit Card | |||

| Reconcile The Credit Card Statement | 00:09:00 | ||

| Bank Reconciliation | |||

| Bank Statement As A CSV File | 00:27:00 | ||

| Bank Statement Closing Balances | 00:11:00 | ||

| Reconcile The Petty Cash | 00:05:00 | ||

| Payroll / Wages | |||

| Wages And Salaries | 00:09:00 | ||

| Post the Wages Journal | 00:07:00 | ||

| Report Wages Journal | 00:02:00 | ||

| Payday | 00:11:00 | ||

| Pay The Two Staff | 00:05:00 | ||

| VAT - Value Added Tax | |||

| Depreciation | 00:04:00 | ||

| VAT Return | 00:04:00 | ||

| Reports | |||

| Month End Reports PnL, BS, TB | 00:05:00 | ||

| Payroll unit | |||

| Using Payroll | 00:12:00 | ||

| Setting Up Employees | 00:10:00 | ||

| Running Payroll – An Example | 00:14:00 | ||

| Conclude | |||

| Recap And Next Steps | 00:06:00 | ||

| What happens next | 00:02:00 | ||

| Assignment | |||

| Assignment – Xero Accounting And Bookkeeping Training | 2 weeks, 1 day | ||

| Order Your Certificate | |||

| Order your Certificate QLS | 00:00:00 | ||

Frequently asked questions

Can’t find the anwser you’re looking for ? Reach out to customer support team.

There are no specific prerequisites for this course, nor are there any formal entry requirements. All you need is an internet connection, a good understanding of English and a passion for learning for this course.

You have the flexibility to access the course at any time that suits your schedule. Our courses are self-paced, allowing you to study at your own pace and convenience.

For this course, you will have access to the course materials for 1 year only. This means you can review the content as often as you like within the year, even after you've completed the course. However, if you buy Lifetime Access for the course, you will be able to access the course for a lifetime.

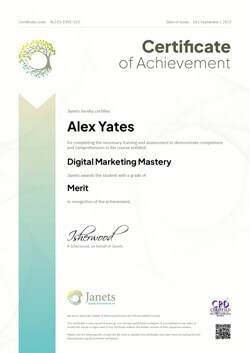

Yes, upon successfully completing the course, you will receive a certificate of completion. This certificate can be a valuable addition to your professional portfolio and can be shared on your various social networks.

We want you to have a positive learning experience. If you're not satisfied with the course, you can request a course transfer or refund within 14 days of the initial purchase.

Our platform provides tracking tools and progress indicators for each course. You can monitor your progress, completed lessons, and assessments through your learner dashboard for the course.

If you encounter technical issues or content-related difficulties with the course, our support team is available to assist you. You can reach out to them for prompt resolution.

LOGIN/Sign up

LOGIN/Sign up