Sage 50 Payroll Complete Course

Level 7 QLS Endorsed | 24/7 Student Support | 50% OFF Certificate & Transcript

5187 Students enrolled on this course 4.6 (12 Reviews)

Last updated April 17, 2024

Last updated April 17, 2024

Course Curriculum

| Sage 50 Payroll for Beginners | |||

| Module 1: Payroll Basics | |||

| Module 1: Payroll Basics | 00:10:00 | ||

| Module 2: Company Settings | |||

| Module 2: Company Settings | 00:08:00 | ||

| Module 3: Legislation Settings | |||

| Module 3: Legislation Settings | 00:07:00 | ||

| Module 4: Pension Scheme Basics | |||

| Module 4: Pension Scheme Basics | 00:06:00 | ||

| Module 5: Pay Elements | |||

| Module 5: Pay Elements | 00:14:00 | ||

| Module 6: The Processing Date | |||

| Module 6: The Processing Date | 00:07:00 | ||

| Module 7: Adding Existing Employees | |||

| Module 7: Adding Existing Employees | 00:08:00 | ||

| Module 8: Adding New Employees | |||

| Module 8: Adding New Employees | 00:12:00 | ||

| Module 9: Payroll Processing Basics | |||

| Module 9: Payroll Processing Basics | 00:11:00 | ||

| Module 10: Entering Payments | |||

| Module 10: Entering Payments | 00:12:00 | ||

| Module 11: Pre-Update Reports | |||

| Module 11: Pre-Update Reports | 00:09:00 | ||

| Module 12: Updating Records | |||

| Module 12: Updating Records | 00:09:00 | ||

| Module 13: e-Submissions Basics | |||

| Module 13: e-Submissions Basics | 00:09:00 | ||

| Module 14: Process Payroll (November) | |||

| Module 14: Process Payroll (November) | 00:16:00 | ||

| Module 15: Employee Records and Reports | |||

| Module 15: Employee Records and Reports | 00:13:00 | ||

| Module 16: Editing Employee Records | |||

| Module 16: Editing Employee Records | 00:07:00 | ||

| Module 17: Process Payroll (December) | |||

| Module 17: Process Payroll (December) | 00:12:00 | ||

| Module 18: Resetting Payments | |||

| Module 18: Resetting Payments | 00:05:00 | ||

| Module 19: Quick SSP | |||

| Module 19: Quick SSP | 00:10:00 | ||

| Module 20: An Employee Leaves | |||

| Module 20: An Employee Leaves | 00:13:00 | ||

| Module 21: Final Payroll Run | |||

| Module 21: Final Payroll Run | 00:07:00 | ||

| Module 22: Reports and Historical Data | |||

| Module 22: Reports and Historical Data | 00:08:00 | ||

| Module 23: Year-End Procedures | |||

| Module 23: Year-End Procedures | 00:09:00 | ||

| Sage 50 Payroll Intermediate Level | |||

| Module 1: The Outline View and Criteria | |||

| Module 1: The Outline View and Criteria | 00:11:00 | ||

| Module 2: Global Changes | |||

| Module 2: Global Changes | 00:07:00 | ||

| Module 3: Timesheets | |||

| Module 3: Timesheets | 00:12:00 | ||

| Module 4: Departments and Analysis | |||

| Module 4: Departments and Analysis | 00:11:00 | ||

| Module 5: Holiday Schemes | |||

| Module 5: Holiday Schemes | 00:10:00 | ||

| Module 6: Recording Holidays | |||

| Module 6: Recording Holidays | 00:12:00 | ||

| Module 7: Absence Reasons | |||

| Module 7: Absence Reasons | 00:13:00 | ||

| Module 8: Statutory Sick Pay | |||

| Module 8: Statutory Sick Pay | 00:16:00 | ||

| Module 9: Statutory Maternity Pay | |||

| Module 9: Statutory Maternity Pay | 00:17:00 | ||

| Module 10: Student Loans | |||

| Module 10: Student Loans | 00:09:00 | ||

| Module 11: Company Cars | |||

| Module 11: Company Cars | 00:13:00 | ||

| Module 12: Workplace Pensions | |||

| Module 12: Workplace Pensions | 00:21:00 | ||

| Module 13: Holiday Funds | |||

| Module 13: Holiday Funds | 00:13:00 | ||

| Module 14: Roll Back | |||

| Module 14: Process Payroll (November) | 00:11:00 | ||

| Module 15: Passwords and Access Rights | |||

| Module 15: Passwords and Access Rights | 00:08:00 | ||

| Module 16: Options and Links | |||

| Module 16: Options and Links | 00:10:00 | ||

| Module 17: Linking Payroll to Accounts | |||

| Module 17: Linking Payroll to Accounts | 00:08:00 | ||

| Mock Exam | |||

| Mock Exam- Sage 50 Payroll Complete Course | 00:20:00 | ||

| Final Exam | |||

| Final Exam- Sage 50 Payroll Complete Course | 00:20:00 | ||

| Assignment | |||

| Assignment – Sage 50 Payroll Complete Course | 3 weeks, 4 days | ||

| Recommended Materials | |||

| Workbook – Sage 50 Payroll Complete Course | 2 weeks, 1 day | ||

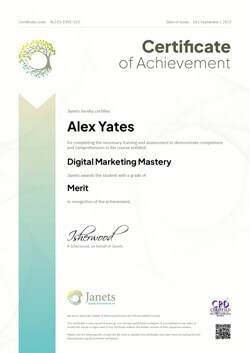

| Order Your Certificate | |||

| Order your Certificate QLS | 00:00:00 | ||

Course Reviews

Frequently asked questions

Can’t find the anwser you’re looking for ? Reach out to customer support team.

Sage 50 is a popular accounting software designed for small and medium-sized businesses. It offers features for managing finances, invoicing, inventory, and reporting. Sage 50 helps businesses streamline their accounting processes, track expenses, and ensure compliance with financial regulations.

Sage Payroll is a module/component within the Sage 50 software suite that helps with payroll management for businesses. It enables users to process payroll, calculate employee wages, generate payslips, and manage tax filings. Sage Payroll reduces errors and ensures compliance with payroll regulations.

Sage Payroll is not typically free; it is a paid module/component within the Sage 50 accounting software. Businesses need to purchase a Sage 50 subscription that includes the payroll feature to access its functionalities. However, Sage may offer trial versions or promotional offers for new users to try out the software.

The cost of Sage 50 varies depending on the subscription plan and the features included. Pricing typically ranges from around $50 to $100 per month for a single-user license. Additional costs may apply for add-on modules/components or multi-user licenses, and discounts may be available for annual subscriptions.

Yes, Sage 50 includes a payroll module/component called Sage Payroll, which enables users to manage payroll processes efficiently. With Sage Payroll, one can calculate employee wages, generate payslips, handle tax filings and much more.

Yes, Sage is well-regarded for its payroll functionality, offering various features. Businesses trust Sage Payroll for its accuracy, reliability, and ease of use, making it a popular choice for payroll management.

Sage is known for its user-friendly interface and intuitive design, making it relatively easy to use for accounting and payroll tasks. The software provides helpful tutorials and customer support resources to assist users in using the system and performing functions efficiently.

Sage offers specialized accounting and payroll functionalities tailored to business needs, whereas Excel is a generic spreadsheet tool. While Excel can handle basic calculations and data entry, Sage provides advanced features for financial management, reporting, and compliance, offering greater accuracy, efficiency, and scalability for business operations.

Sage is considered one of the best accounting software solutions for small and medium-sized businesses due to its comprehensive features, user-friendly interface, and reputation for reliability and support. It offers a range of products and services to meet diverse business needs, making it a trusted choice for financial management.

Sage takes security seriously and implements measures to protect user data and payment information. The company employs encryption protocols, secure data storage practices, and compliance with industry standards to safeguard sensitive information and prevent unauthorised access or breaches.

LOGIN/Sign up

LOGIN/Sign up

Frank Smith

It’s one of the best courses I have ever did! It has directly and positively impacted upon my skills and confidence.

Alberto Dussault

Excellent course. To the point on how to use the program. Some basic accounting info included which I really liked about it. Thank you!

Erica Perkins

This is a complete explanation of Sage 50 Payroll covering each box and option. It has been beneficial all the way through.

Keith Morgan

“Detail Explanation. Superb!

Step by step explanations are very useful and gives a good insight for beginners.”

Victoria Vasquez

I am an accountant; taking this course has acquainted a lot of things when it’s come to technical. Both beginner and intermediate levels were well explained. I will definitely recommend this to others.

Tom Couch

Excellent course with proper explanation. The tutorials are straight forward, practical and easy to grasp. Highly recommended!

good course

it was really helpful, a lot of practical things that are useful, alongside with theory which is neccessary.

can only recommend if somebody is interested in Payroll job

Grace Moore

This course is exceptionally good. It covered everything I needed to know about sage 50 payroll. I’ll recommend this course to everyone.

Kate Ali

The price of the course is reasonable. The course material is easy but a little bit unorganized. I’ll suggest to improvise the curriculum. Not a bad experience.

Amy Lord

very informative course on sage 50. I have learned a lot of payroll and I recommend this sage 50 payroll course to those looking for a convinent course on sage 50 payroll

Megan Morley

I liked the course content. But I’ll suggest to enlarge the font size of operation menue. It was a good course overall.

Harry Macdonald

The £10 I spent on this Sage 50 Payroll course was worth every penny. The course covers all the aspects of sage 50 payroll. I highly recommend this course .