Xero Accounting and Bookkeeping Course

Level 7 QLS Endorsed | 24/7 Student Support | 50% OFF Certificate & Transcript

3419 Students enrolled on this course 4.5 (10 Reviews)

Last updated April 16, 2024

Last updated April 16, 2024

Course Curriculum

| Introduction | |||

| Introduction | 00:02:00 | ||

| Getting Started | |||

| Introduction – Getting Started | 00:01:00 | ||

| Signing up to Xero | 00:04:00 | ||

| Quick Tour of Xero | 00:12:00 | ||

| Initial Xero Settings | 00:13:00 | ||

| Chart of Accounts | 00:14:00 | ||

| Adding Bank Accounts | 00:08:00 | ||

| Demo Company | 00:04:00 | ||

| Tracking Categories | 00:07:00 | ||

| Contacts | 00:12:00 | ||

| Invoices and Sales | |||

| Introduction – Invoices and Sales | 00:01:00 | ||

| Sales Screens | 00:04:00 | ||

| Invoice Settings | 00:13:00 | ||

| Creating an Invoice | 00:18:00 | ||

| Repeating Invoices | 00:07:00 | ||

| Credit Notes | 00:10:00 | ||

| Quotes Settings | 00:03:00 | ||

| Creating Quotes | 00:07:00 | ||

| Other Invoicing Tasks | 00:03:00 | ||

| Sending Statements | 00:03:00 | ||

| Sales Reporting | 00:05:00 | ||

| Bills and Purchases | |||

| Introduction – Bills and Purchases | 00:01:00 | ||

| Purchases Screens | 00:04:00 | ||

| Bill Settings | 00:02:00 | ||

| Creating a Bill | 00:13:00 | ||

| Repeating Bills | 00:05:00 | ||

| Credit Notes | 00:06:00 | ||

| Purchase Order Settings | 00:02:00 | ||

| Purchase Orders | 00:08:00 | ||

| Batch Payments | 00:12:00 | ||

| Other Billing Tasks | 00:02:00 | ||

| Sending Remittances | 00:03:00 | ||

| Purchases Reporting | 00:05:00 | ||

| Bank Accounts | |||

| Introduction – Bank Accounts | 00:01:00 | ||

| Bank Accounts Screens | 00:07:00 | ||

| Automatic Matching | 00:04:00 | ||

| Reconciling Invoices | 00:06:00 | ||

| Reconciling Bills | 00:03:00 | ||

| Reconciling Spend Money | 00:05:00 | ||

| Reconciling Receive Money | 00:04:00 | ||

| Find and Match | 00:04:00 | ||

| Bank Rules | 00:09:00 | ||

| Cash Coding | 00:03:00 | ||

| Remove and Redo vs Unreconcile | 00:04:00 | ||

| Uploading Bank Transactions | 00:07:00 | ||

| Automatic Bank Feeds | 00:06:00 | ||

| Products and Services | |||

| Introduction – Products and Services | 00:01:00 | ||

| Products and Services Screen | 00:02:00 | ||

| Adding Services | 00:03:00 | ||

| Adding Untracked Products | 00:03:00 | ||

| Adding Tracked Products | 00:07:00 | ||

| Fixed Assets | |||

| Introduction – Fixed Assets | 00:01:00 | ||

| Fixed Assets Settings | 00:06:00 | ||

| Adding Assets from Bank Transactions | 00:06:00 | ||

| Adding Assets from Spend Money | 00:05:00 | ||

| Adding Assets from Bills | 00:02:00 | ||

| Depreciation | 00:04:00 | ||

| Payroll | |||

| Introduction – Payroll | 00:01:00 | ||

| Payroll Settings | 00:15:00 | ||

| Adding Employees | 00:18:00 | ||

| Paying Employees | 00:10:00 | ||

| Payroll Filing | 00:04:00 | ||

| Vat Returns | |||

| Introduction – VAT Returns | 00:01:00 | ||

| VAT Settings | 00:02:00 | ||

| VAT Returns – Manual Filing | 00:06:00 | ||

| VAT Returns – Digital Filing | 00:02:00 | ||

| Next Steps and Bonus Lesson | |||

| What Now? | 00:01:00 | ||

| Mock Exam | |||

| Mock Exam – Xero Accounting and Bookkeeping Course | 00:20:00 | ||

| Final Exam | |||

| Final Exam – Xero Accounting and Bookkeeping Course | 00:20:00 | ||

| Assignment | |||

| Assignment – Xero Accounting and Bookkeeping Course | 3 weeks, 4 days | ||

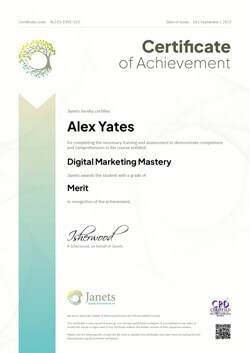

| Order your Certificates & Transcripts | |||

| Order your Certificates & Transcripts | 00:00:00 | ||

Course Reviews

Frequently asked questions

Can’t find the anwser you’re looking for ? Reach out to customer support team.

Xero is an accounting software designed for small to medium-sized businesses. It helps with various financial tasks such as invoicing, bank reconciliation, inventory management, and expense tracking. It aims to streamline accounting processes and provide real-time visibility into a company's financial situation.

Xero and QuickBooks share similarities as both are cloud-based accounting software solutions. They both offer features for invoicing, expense tracking, and reporting. However, their user interfaces and specific features differ, so users may prefer one over the other based on their specific needs and preferences.

Xero offers a free trial, but it is not entirely free for use. After the trial period, users need to choose a paid subscription plan based on their business needs. However, Xero does offer various pricing tiers to cater to different business sizes and requirements.

One advantage of Xero is its user-friendly interface and accessibility from anywhere with internet connection. It also integrates with many third-party apps, simplifying tasks like payroll, inventory management, and CRM. Additionally, its real-time data updates enable users to make financial decisions quickly.

Xero operates as a cloud-based platform, meaning users access it through a web browser or mobile app. Users can input financial data, reconcile bank transactions, generate reports, and collaborate with team members or accountants in real-time. Its intuitive design aims to streamline accounting tasks for businesses of all sizes.

Xero is known for its ease of use, with a simple and intuitive interface that requires minimal training to use. Its dashboard provides a clear overview of financial data, and tasks such as invoicing and reconciling transactions are straightforward, making it suitable for users with varying levels of accounting knowledge.

While Xero offers features commonly associated with bookkeeping, it is more comprehensive than traditional bookkeeping. It provides additional functionalities like inventory management, payroll processing, and reporting, making it a full-fledged accounting solution for businesses.

Xero employs industry-standard security measures to safeguard users' financial data. These measures include data encryption, secure data centers, and regular security audits. Additionally, users can enable two-factor authentication for an extra layer of protection, ensuring the safety and integrity of their accounting information.

Yes, Xero is an online-only accounting software, meaning it is accessed via web browsers or mobile apps and requires an internet connection to use. This cloud-based approach offers the advantage of accessibility from anywhere, as well as real-time data updates and automatic backups.

To use Xero accounting software, users do not need to download any software onto their devices. Instead, they can sign up for an account on the Xero website and access the platform through a web browser or by downloading the mobile app from app stores for iOS and Android devices.

LOGIN/Sign up

LOGIN/Sign up

Morgan Lloyd

Learning Xero was a dream come true for me! Excellent courses. HIGHLY RECOMMENDED.

Robert Duncan

This is the best Xero Accounting and Bookkeeping course I have taken so far. Loved the experience and lessons. On top of that, it is super cheap. You can afford it easily.

Lola Carr

Great course! I have learned a lot about Xero accounting and bookkeeping. It is the best online accredited course in the UK

Jay Talbot

This was my first online tutorial and it happened to be on Xero accounting and bookkeeping. They sparked my interest with a brilliant website and the highest accreditation in the UK. Excellent course materials!

Zachary Russell

This course is great. If you’re looking for a course to improvise your accounting and bookkeeping skills, this is the right place for you. I’ll recommend anyone to take this course.

Tyler Stephens

I completed all of the evaluations and received the certificate… it’s perfect! Thank you for giving me the chance to learn about Xero. I never imagined I’d be able to study again.

Katie Moss

This course is just what I needed as I’ve just recently started using the Xero Accounting System. It covers all of the essentials for getting started with the System. The videos are straightforward and succinct, and the tutor’s voice is one of my favorites. I’m so glad I came across this course.

John Lewis

This is the best course to study Xero. I have cleared all the text and got my certificate.

Paige Holden

This course made me an expert in Xero am really satisfied with it.

Phoebe Cox

This is one of the best Xero Accounting and Bookkeeping Course! I didn’t think I’ll find such a comprehensive course online. It helped me a lot with my problems. I will recommend it to everyone!